Fractal buying power

This is an interesting perspective on the bull market for enormously expensive, high-end art. From the New York Times. The analysis of the fractal patterns of income distribution in the highest percentiles isn’t something I’ve read before:

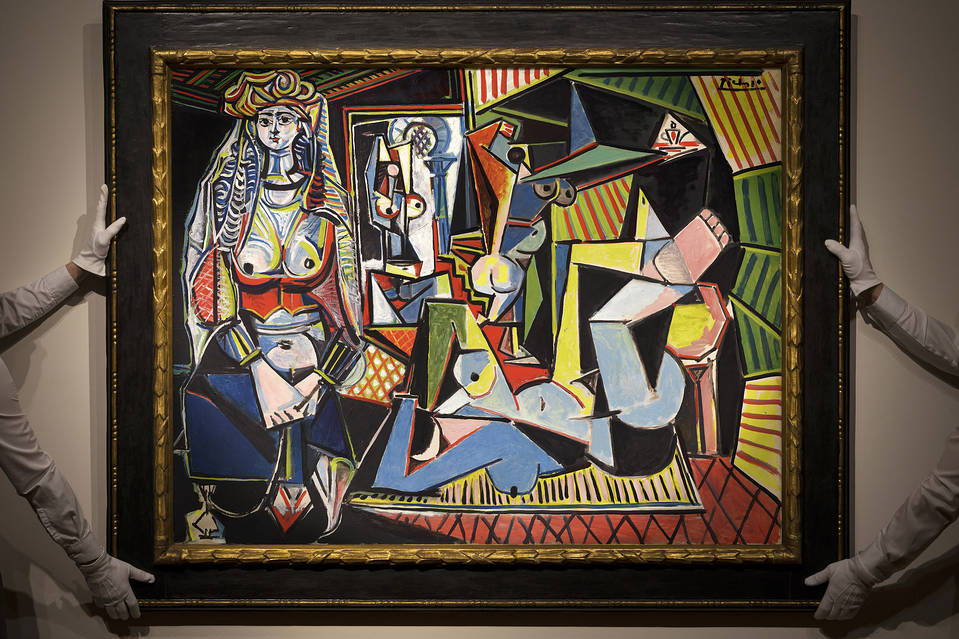

The astronomical rise in prices for the most-sought-after works of art over the last generation is in large part the story of rising global inequality. At its core, this is the simplest of economic math. The supply of Picasso paintings or Giacometti sculptures (one of which sold for $141 million in the same auction this week) is fixed. But the number of people with the will and the resources to buy top-end art is rising, thanks to the distribution of extreme wealth.

One of the most important findings of the leading economists who study inequality is that wealth and incomes at the very top are “fractal.” What they mean is that when you zoom in on the upper end of wealth distribution, patterns repeat themselves in an ever more finely grained pattern.

Partners at law firms who are in the top 1 percent of all earners have seen their incomes rise faster than successful dentists who are in the top 10 percent. But by a similar margin C.E.O.s of large companies who are in the top 0.1 percent are seeing incomes rise faster than those law firm partners. Hedge fund managers in the top 0.01 percent are similarly outperforming the C.E.Os.

And the kind of people who can comfortably afford to pay a nine-figure sum for a Picasso, the top 0.001 percent, say, are doing still better than that.

The Washington Post commented on the recent $179 million Picasso sale:

This art market boom isn’t as pretty a picture as it seems, however. First, there are worries that it’s all a bubble that could burst at any moment. But then there are bigger concerns about the wider societal costs of such an inflated art scene.

The person who purchased Picasso’s masterpiece may be anonymous. But there are signs that we are all paying the price for such extravagant private auctions. Public museums can’t keep up with soaring prices. Now the magisterial “Women of Algiers” could disappear back into a dark mansion den or, even worse, a climate-controlled, tax-exempt airport warehouse until it has appreciated sufficiently in value.

Comments are currently closed.